The Role of Governments in Driving Financial Inclusion and Economic Growth

Dr. Ritesh Jain , Founder Infynit, Member G20 GPFI , Founding Member-World Metaverse Council, Digital Euro Association

Amidst the relentless march of digitisation that defines our modern world, a quiet yet profound mission is subtly reshaping the fabric of global economies—a mission centred on the pursuit of all-encompassing financial inclusion. The mission carries immense weight, especially considering that, according to The World Bank, nearly 1.4 billion adults worldwide are still denied access to essential banking services. However, two-thirds of them possess a mobile phone that has the potential to bridge this divide. In parallel, we witness tech giants locked in a fervent race to develop ground-breaking fintech solutions, with investments in this sector soaring to unprecedented heights. Yet, amid digital innovation's excitement, a crucial element is often overlooked—the authentic essence of human connection. Beyond the complex algorithms and intricate lines of code, the fusion of technology with genuine human interaction holds the key to a transformative journey towards financial empowerment. In this exploration, we embark on a voyage that transcends the realm of mere statistics. We delve deep into the intricate web of empathy and equity that underpins the profound significance of financial inclusion—a journey that unveils not only the challenges but also the inspiring human stories and aspirations that underscore the true essence of this global endeavour. As we set forth, we'll explore the challenges in achieving financial inclusion and the pivotal role that governments and global economies play in driving economic growth through the prism of financial inclusion.

The Challenge - Financial Literacy!

Financial inclusion encounters a formidable challenge—the lack of financial literacy among underserved populations. However, within this complex landscape, two powerful tools shine as beacons of hope. Empathy serves as our guiding light, allowing us to step into the shoes of individuals with limited financial knowledge and comprehend their unique needs and fears. For instance, India's Pradhan Mantri Jan Dhan Yojana extends far beyond opening bank accounts for marginalised communities. It combines this endeavour with empathetic financial education initiatives that demystify the basics of saving, budgeting, and borrowing in a relatable and accessible manner. To complement empathy, equity emerges as a vital partner, ensuring that financial literacy programs are not only accessible but also tailored to diverse cultural and linguistic backgrounds. Initiatives such as the Grameen Bank in Bangladesh exemplify this approach by offering inclusive, multilingual materials and collaborating with local community leaders to bridge the gaping chasm of financial illiteracy among women entrepreneurs. These empathetic and equitable strategies pave the way for illuminating the path toward financial inclusion, empowering individuals with the knowledge and tools to engage in the global economy fully. Yet, the significance of financial literacy extends beyond those who are excluded. It forms the linchpin for answering critical financial questions, from securing retirement to securing our children's futures and preparing for unexpected emergencies. Financial literacy and inclusion have become paramount priorities on the global stage, aligning seamlessly with the UN Sustainable Development Goals. These objectives are a resounding call to specialists and non-specialists, urging them to recognise the benefits of improved financial behaviours and well-being through enhanced financial literacy.

A People-Centric Approach to Financial Inclusion

A People-Centric Approach to Financial Inclusion is not just an aspiration; it's an imperative. We confront a stark reality—exclusion from the financial ecosystem persists on a massive scale. Yet, the transformative power of inclusion is undeniable. Studies reveal that for every 1% increase in financial inclusion, a staggering 2.1 million people are lifted out of poverty. This isn't merely a matter of economic statistics; it's about recognising that behind every data point lies a human story—a story of aspirations, resilience, and the innate drive for a better life. To embrace this people-centric ethos is to acknowledge that financial inclusion isn't just an economic mission but a moral obligation. It's an unwavering commitment to ensuring that every individual, regardless of their circumstances, finds a place in the economic tapestry of our world, where opportunity and empowerment are not just buzzwords but the lived experience of all.

Inclusive finance – way forward from G20 GPFI

With years of experience in finance, I've witnessed a powerful force driving change beyond technology and market dynamics: our ethical duty for financial inclusion. Today, we explore Financial Inclusion and the pivotal role of the G20 Global Partnership for Financial Inclusion (G20 GPFI). It's not just a catchphrase; it's a solemn commitment to ensure equitable access to financial services, essential for economic growth and poverty reduction. Why focus on the G20 GPFI? The answer is clear – it embodies global collective action. Achieving financial inclusion demands efforts that transcend borders, aligning with global standards. Enter the Digital Public Infrastructure, the linchpin for inclusion. It's more than a tech upgrade; it's a robust, transparent, and inclusive foundation for our digital financial future. Join us as we explore Financial Inclusion and the transformative potential of Digital Public Infrastructure.

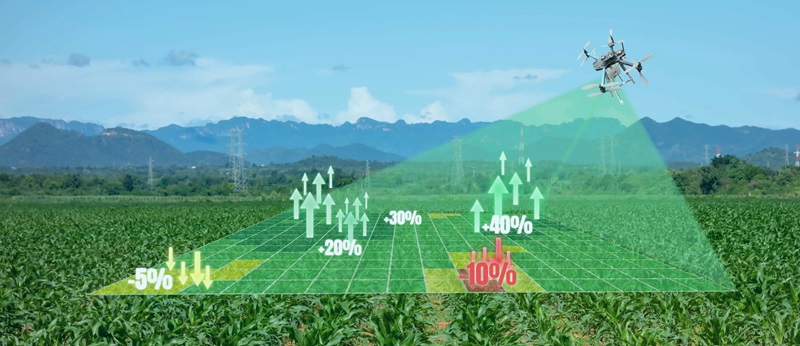

After years in the complex global financial landscape, we face pressing realities. While some regions boast impressive progress, with around 65% of adults in Europe and Central Asia having formal accounts, others must catch up. Consider this – even those with bank accounts often lack access to comprehensive financial services, leaving them with limited credit options, inadequate insurance, and a critical lack of financial literacy. Gender disparities persist, with women trailing men by up to 9 percentage points in certain areas, and the wealth gap remains pronounced. But there's hope. Digital financial services have surged, particularly in East Asia and the Pacific, with a 20% increase in digital transactions. Fintech innovations, powered by technologies like AI and blockchain, offer novel solutions from micro-loans to tailored crop insurance for farmers. However, disparities endure, fueled by infrastructure gaps, regulatory complexities, and cultural hurdles. Our goal transcends mere bank account ownership; it's about meaningful financial engagement and empowerment for all. As industry leaders, we aim to relentlessly bridge these divides and create a more inclusive financial world.

The role of GPFI

In pursuing a more inclusive financial world, we're joined by a formidable ally: the G20 Global Partnership for Financial Inclusion (GPFI). This isn't your average consortium; it's a unique coalition comprising G20 and non-G20 nations, along with key stakeholders. They believe inclusive financial systems are vital for broader development objectives, from reducing poverty to ensuring economic stability.

What sets the GPFI apart is its adaptability. Unlike rigid, one-size-fits-all approaches, it tailors initiatives to suit the specific needs of diverse global financial landscapes. Whether bolstering SME finance in Africa or advancing digital innovations in Asia, the GPFI exhibits remarkable flexibility.

A significant milestone was the launch of the High-Level Principles for Digital Financial Inclusion, emphasising the transformative potential of digital technologies. Importantly, it provided a practical framework for nations to leverage these technologies while ensuring robust consumer protection measures. These aren't empty promises; I've witnessed the GPFI's active engagement, from conducting capacity-building workshops in emerging economies to conducting in-depth studies on financial systems. Their Subgroups, each dedicated to diverse topics, highlight their multifaceted approach. The GPFI functions like a skilled weaver, deftly intertwining national policies, global best practices, and innovative solutions to create a tapestry of global financial inclusion. In essence, the GPFI isn't just a talk shop; it's a force that actively clears the path, fostering collaboration and unity in our shared mission.

Why DPI:

With a vantage point in banking and finance, I firmly believe we are on the brink of a new era defined by Digital Public Infrastructure (DPI). Why the emphasis on DPI? Let's explore this through industry insights. Traditional banking relied on tangible foundations—brick-and-mortar banks, physical currency, and paper records. While effective, these systems showed limitations in our increasingly digitised world. Enter DPI—an amalgamation of digital identity systems, payment networks, and data frameworks. DPI stands out for its agility, scalability, and inclusivity. I've witnessed DPI's transformative potential firsthand, from remote village farmers effortlessly accessing credit and insurance through digital identities to fintech innovators building universally accessible solutions, including peer-to-peer lending platforms and robo-advisory services. DPI isn't just about convenience; it's about resilience. Recent global challenges, including the pandemic, exposed vulnerabilities in traditional systems. Robust DPI regions demonstrated resilience, ensuring accessible and efficient financial systems. In essence, DPI represents more than an upgrade; it signifies a paradigm shift towards democratised financial services, uniting technology with the core principles of financial inclusion.

Benefits of DPI in Financial Inclusion:

As we delve deeper into Digital Public Infrastructure (DPI) and its role in financial inclusion, the potential for reshaping the financial landscape becomes increasingly evident. Several vital facets highlight the transformative power of this integration:

Democratisation of Access: DPI breaks down geographical and logistical barriers, extending financial services beyond urban centres. Through my involvement in grassroots projects, I've witnessed DPI bridging the gap for rural entrepreneurs and marginalised communities.

Cost Efficiency: From an industry perspective, serving clients in remote areas has traditionally incurred significant costs. DPI, however, dramatically reduces operational expenses. Notably, systems like UPI in India have demonstrated the potential to reduce transaction costs substantially, making even small transactions profitable for banks and financial institutions.

Data-Driven Decision-Making: The lack of comprehensive data has long challenged lending and investment decisions. DPI platforms provide a wealth of transactional and behavioural data, refining risk assessment and enabling tailored financial products for underserved segments.

Enhanced Security and Trust: DPI addresses security concerns that stakeholders often raise. Advanced encryption and biometric verifications like Aadhaar ensure secure financial transactions and data. This fosters trust, a crucial element in financial engagements, particularly for communities traditionally wary of formal financial systems.

Empowering Innovations: Collaborating with fintech pioneers has shown DPI's catalytic role. It offers a ready-made infrastructure upon which innovations, from micro-insurance to specialised savings products, can be built, scaled, and made accessible to all.

In essence, the convergence of DPI and financial inclusion is far more than a mere technological fusion; it represents a harmonious blend with the potential to shape a future where the financial world is inclusive, welcoming, and empowering for every individual.

"In the quest for comprehensive financial inclusion, the indispensable human touch remains the secret ingredient. Understanding diverse needs through empathy is key to crafting relevant and humane financial solutions."

DPI: An Enabler, not a Panacea for Financial Inclusion

The path to achieving comprehensive financial inclusion is rife with obstacles. From trust deficits and limited financial education to deeply rooted sociocultural barriers, these challenges demand innovation, unwavering patience, and unyielding determination. While financial institutions possess considerable resources, grassroots organisations offer invaluable local insights. The collaboration between these two spheres, characterised by shared knowledge and pooled resources, has the potential to amplify the impact of financial inclusion efforts. However, it's essential to recognise that DPI, while a powerful enabler, is not the sole solution. We must address the critical issue of financial literacy at the grassroots level before genuine financial inclusion is elusive. Even with impressive statistics like 90% financial inclusion, the system needs to improve its practical effectiveness if paired with a mere 30% financial literacy rate. This challenge extends beyond emerging economies; developed countries face similar hurdles. In the United Kingdom, for instance, 78% of people lack knowledge about when they make minimum payments on their credit cards, resulting in higher interest rates. The challenge of financial literacy is pervasive and far-reaching, underlining the need for a holistic approach to achieving true financial inclusion.

Conclusion: Illuminating the Path to Inclusive Financial Empowerment

The quest for universal financial inclusion is reshaping global economies in a world of rapid digitisation. While technology evolves, we must remember the essence of human connection as the catalyst for transformative financial empowerment. This exploration has unveiled statistics and profound human stories underpinning our global mission. Financial literacy looms as a critical challenge among underserved populations, but within this complexity, empathy and equity emerge as beacons of hope. Empathy allows us to understand unique needs, as seen in India's Pradhan Mantri Jan Dhan Yojana. Equity ensures accessible, culturally tailored programs, exemplified by the Grameen Bank in Bangladesh. Together, these elements illuminate the path to financial inclusion, equipping individuals to participate fully in the global economy. Financial literacy extends beyond the excluded; it's the universal key to effective money management, aligning with global goals for enhanced financial well-being.

A people-centric approach is not just an aspiration; it's a moral imperative. For every 1% increase in financial inclusion, 2.1 million people escape poverty. The G20 Global Partnership for Financial Inclusion (GPFI) plays a pivotal role, weaving together policies, best practices, and innovation to create a tapestry of global financial inclusion.

Digital Public Infrastructure (DPI) signifies a paradigm shift, democratising financial services, reducing costs, and fostering trust. However, DPI is an enabler, not a panacea. Our journey to true financial inclusion must address the omnipresent challenge of financial literacy.

In conclusion, we stand at the dawn of a new era driven by technology, empathy, and equity. Our path is illuminated by global collaboration, DPI's transformative potential, and an unwavering commitment to making financial inclusion a lived experience for all. Let us forge ahead with empathy, equity, and innovation, ensuring that financial inclusion becomes a reality for everyone, regardless of their circumstances.

The Journey into industry

Dr. Ritesh Jain, a top 10 Global Fintech Leader, founder, tech enthusiast, and seasoned board advisor, has over two decades of experience in global Digital Technology, Business Transformation, and Operations. As a regular speaker at global conferences on Fintechs, Emerging Tech, Banks, and Payments, he has made a lasting impact on the industry. Formerly the COO and Global Head of Digital Tech at HSBC, he led the future of Payments at VISA and introduced Apple Pay. At Maersk, he spearheaded technology and innovation, establishing Digital Centers of Excellence and robust high-availability platforms. His contributions earned him a PhD in Payments Innovation, Open Banking, and Financial Inclusion. Dr. Jain is a founding member of the World Metaverse Council, Blockchain Associations, IBM/Informa’s AI Community, and a visiting faculty member at leading business schools. He also serves as a member advisor of the G20 GPFI and offers guidance to major payment programs and banks worldwide while advising banks and central banks on emerging tech and the future of banking and payments.